Andrew Smith thinks the decline in the freight market as a freight broker in the last year has been linked to oversupply. Smith is a senior vice president at Circle Logistics in the US. He’s seen the ups and downs in the industry for over 14 years, speaking to a thousand shippers regularly. He manages about $250 million worth of truckload freight business units, which he built from the ground up.

“If you go back to post-COVID supply chain issues. It created a supply chain bubble, and a lot of companies got a lot of venture capital to go out to the market,” Smith says.

Earlier this month, Locate2u reported on the digital freight startup Convoy shutting its doors, blaming a “massive freight recession and contraction in the capital markets.”

Freightwaves reports that Flexport is in talks with Convoy to purchase its technology assets. Flexport will allegedly hire a small team of Convoy employees to help with the transition.

Locate2u News sat down with Smith to speak about the so-called freight recession.

“As a freight broker, like Convoy and Circle, we operate in the middle space. Typically, a lot of primary lanes, or heavy, dense lanes, have historically not gone to brokers. Those go directly to asset-based companies. Where brokers fit into the market, for the most part, is in less dense lanes or more one-off project-type opportunities,” says Smith.

Convoy is one of many digital freight brokers to go under. “I know Convoy had some dedicated opportunities that relied on volume drop trailers. But still, historically, where brokers make most of their money comes in the cream of the top of the industry. When you haven’t oversupplied, that goes away,” says Smith.

There is no freight recession

Last year, Smith posted on his LinkedIn, predicting that Convoy might not make it. This was based on what happened to other digital freight companies, which started as brokerages before selling technology. “That usually, to me, is the sign that they’re not doing well.”

“I’m convinced these venture capital companies that keep trying to invent invest into freight tech. Every phone call my staff makes, whether that’s scheduling an appointment to pick up or deliver a load, these are things that you cannot automate today, maybe in 10 years, in 20 years,” says Smith.

He doesn’t anticipate a freight recession. “Volumes are still there. Rates have come down. Gross margins have come down,” says Smith, warning about the risk in 2024. “I think next year is going to be more demand-driven, while the last year and the decline in the markets has just been supply-driven.”

Who will sink next?

Smith believes the companies that are going out of business now had “either poor or dysfunctional business models to begin with” or were just well under-capitalized for a normalizing market.

Planning for margins seen today is essential. That’s precisely what the team at Circle Logistics believes is keeping them financially healthy. “We recognize that the margins over the last two years aren’t sustainable and are atypical of historically, what, where freight brokerage fits into the market,” says Smith.

What should shippers be thinking about right now?

Convoy won’t be the last broker to go under. The financial viability of business partners and your business model are the two vital things any shipper must think of right now.

“I have 1,000 shippers that we work with from month to month in Circle. Shockingly, these two things aren’t questioned. If a middleman goes under, the shippers are still responsible for paying the freight bill,” says Smith. He adds that in some instances, if their partner goes under, they might end up paying for their freight bill twice.

The second thing shippers must be thinking of right now is the outlook of their partner’s carrier base. “There’s a lot of fraud going on in the industry. So, how are your partners combating that fraud? What are they doing to prevent that fraud?”

Smith says at Circle, they have an entire fraud prevention team. “I think that when insurance renewals come around for brokers and trucking companies over the next two months, you’re going to see carrier exits accelerate. This because the premiums are going up way more than what we’ve ever seen due to a lot of the fraud cargos,” says Smith.

The last thing he would advise shippers to think about is to ensure they are aligned with strategic partners based on whatever volume is expected for next year. “I don’t expect within the next six months that there’s going to be a huge volume increase where I need these providers again,” he says.

Pruning the industry

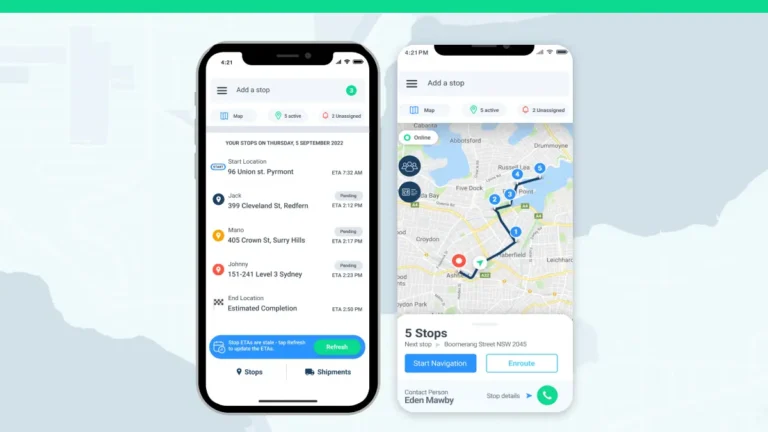

“Once these carrier exits and the pruning happening in the industry is over, I think the shippers need to be prepared to rely on strategic partners that can move their freight and move their freight with quality tracking.”

Smith says if a partner can’t deliver accurate time tracking, they need to be looked at with extra scrutiny. “I’d be looking at the tech of the freight partners that you have and making sure that you’re set up for a turnaround in the freight market sometime in the future.”

About the author

Mia is a multi-award-winning journalist. She has more than 14 years of experience in mainstream media. She's covered many historic moments that happened in Africa and internationally. She has a strong focus on human interest stories, to bring her readers and viewers closer to the topics at hand.