In a recent turn of events, Braid, a consumer payments startup founded in January 2019 to popularize shared wallets among consumers, has announced its closure.

The San Francisco-based company, co-founded by Amanda Peyton and Todd Berman (who left in 2020), wanted to provide users with an FDIC-insured, multi-user account, simplifying the process of pooling, managing, and spending money collectively.

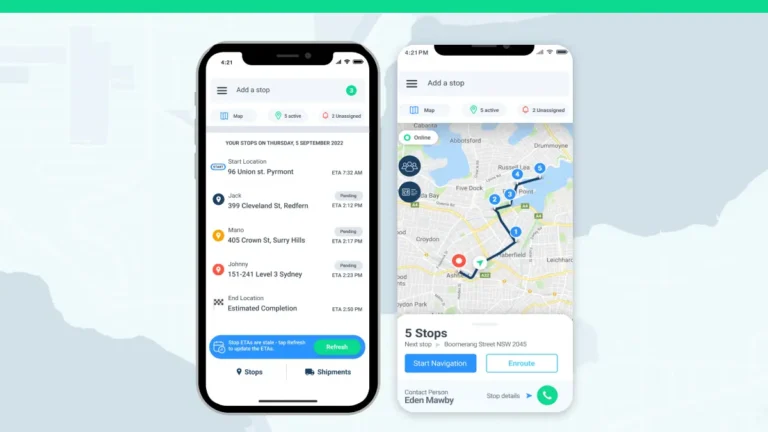

Using Braid, individuals could contribute to a shared fund for common goals, such as saving for a group vacation, and utilize a branded debit card for transactions.

Braid’s sunset era

Despite Braid’s innovative concept, the startup faced insurmountable challenges, leading to its closure. Over its four-year journey, Braid secured $10 million in funding through multiple rounds, with support from investors like Index Ventures and Accel.

In a heartfelt blog post, Amanda Peyton, the co-founder of Braid, shares the story of the company’s rise and fall.

“It took us ~2.5 years to find product-market fit, and after that, we grew sustainably and quickly. We’d made software that people seemed to want. A few months later, we were dead. The thrash happened fast and left a sea of heartbroken customers, employees, investors, and partners. The thing that broke us wasn’t a stronger blow than any of the others, it was simply the last one we could tolerate,” she writes. She admits that Braid had shut its doors in September, acknowledging the venture’s lack of viability as a business.

Facing unique challenges

She elaborates on Braid’s challenges, including issues with a sponsor bank that left the company stagnant from July 2022 to January 2023.

Braid could not process any payment volume during the six months, creating a significant knock. Despite finding a new sponsor bank, Braid continued to face obstacles. One key lesson Peyton highlights is minimizing reliance on third-party software, often leading to complications.

Following the shutdown, Peyton acquired Braid’s intellectual property in an auction, expressing her enduring passion for fintech and the vast opportunities within the payments sector.

Meet the name

Before her venture with Braid, Peyton had a notable career, having worked at Google and Etsy, according to her LinkedIn profile. She also co-founded Grand St., a marketplace for creative and indie technology products, later acquired by Etsy in 2014.

In reflecting on her entrepreneurial journey, Peyton emphasizes the importance of recognizing the less discussed aspect of the startup lifecycle: failure. Despite the challenges faced by Braid, Peyton’s determination and enthusiasm for fintech innovation remain undeterred, indicating the potential for future endeavours in the ever-evolving realm of fintech.