Dramatic leadership shakeups and a massive freight recession led to the rise and collapse of Convoy and the restructuring of Flexport. Based in the US, with 1,300km of land between the two logistics companies, Convoy and Flexport suffered devastating blows to the business. The difference is that Fexport is on the victory path again, while Convoy had to call it a day.

Locate2u explores the reasons behind the business decisions, the triumphs, mistakes, and regrets.

Flexport leadership shakeup

Flexport’s problems started bubbling to the surface in early September and reached a boiling point when founder Ryan Petersen announced his co-CEO Dave Clark’s sudden departure. It opened the door for a massive management shakeup and more exits of strategic leaders.

In his letter to employees, Petersen says: “Customers need to be able to count on Flexport as a reliable partner for their supply chain.” He blamed Clark indirectly for heavily investing in “hiring hundreds of software engineers.”

Petersen would later terminate an offer letter given to employees just a few hours before they were supposed to join. A week before Convoy shut down operations in October, Flexport fired 600 staff members. Petersen says it was necessary to return the company to profitability again.

Two weeks went by before Flexport finally announced what many suspected. Flexport would be acquiring Convoy’s technology stack. With green shoots on the horizon and the support from US president Joe Biden, things are looking better for the supply chain management company.

How Convoy collapsed

Convoy had big plans to transform the trucking industry. In 2018, it told Geek Wire it was ready to spread its wings outside Seattle with a new office. “The company plans to hire hundreds of employees at its new office to support its on-demand Uber-like technology platform that matches trucking companies and shippers. It will be staffed by operations, support, and account management teams that can better serve customers on East Coast time.”

Ironically, it anticipated a “huge opportunity in the US trucking industry” with investors like Microsoft founder Bill Gates and Amazon founder Jeff Bezos.

Before the devastating COVID-19 pandemic, Convoy added 100 employees to its Seattle team and shared plans to “hire aggressively” more staff in January 2020.

Suddenly, the tables turned, and Convoy was in a financial crisis in 2023. In a memo, co-founder Dan Lewis told employees: “Convoy will be closing down its current core business operations.”

FreightWaves believes it has something to do with Convoy’s trailer leasing cost. With 4,000 trailers under lease, it is estimated to cost the company around $20 -$25 a day. It further claims that Convoy could have earned up to $100,000 when the market was good. But when the market collapsed, it changed the dynamics.

Not everyone agrees with this argument. “Convoy had a large-scale fleet with optimized procurement and maintenance. The cost per trailer was way lower. In the peak of tightness, we would make $1,000 in profit per load,” says a person on X, who claims he has built Convoy’s trailer business.

Why startups fail

Software company Upsilonit found that startups in the IT industry are highly prone to failure. However, the tech startup success rate is less than 50%. On average, 63% of tech startups don’t make it, and 25% close down during the first year. It also found that only 10% survive in the long run. Venture-backed fintech startups fail in 75% of cases.

Other sectors are also receptive to failure:

- Startups in the e-commerce and retail sectors fail in 53% of cases.

- Construction is also a harsh industry to survive in, with a 53% failure rate.

- Manufacturing has a 51% startup failure rate.

- Blockchain and cryptocurrency startups have a shocking 95% failure rate and a very short lifespan.

According to the research done by Upsilonit, it’s highly unlikely that a startup will reach profitability within its first year. It’s believed in the industry that it could take between three and four years to become profitable.

In Flexport and Convoy’s experience, both reaching the 10-year mark, 65-70% of startups with this amount of experience go out of business before reaching a century.

Convoy was founded in 2015, while Flexport was founded in 2013. Many analyzed the fall of Convoy as the highlight of the trucking industry’s massive crisis.

Andrew Smith, senior vice president at Circle Logistics in the US, told Locate2u he believes Convoy is one of many digital freight brokers to go. “I know Convoy had some dedicated opportunities that relied on volume drop trailers. But still, historically, where brokers make most of their money comes in the cream of the top of the industry. When you haven’t oversupplied, that goes away.”

Smith believes there is no truck recession as Convoy alluded to in its last note to staff in October. “Volumes are still there. Rates have come down. Gross margins have come down.” But he does warn of a risk next year. “I think next year is going to be more demand-driven, while the last year and the decline in the markets has just been supply-driven.”

Looking forward in 2024

Shippers must be prepared to rely on “strategic partners” who can move their freight with quality tracking next year.

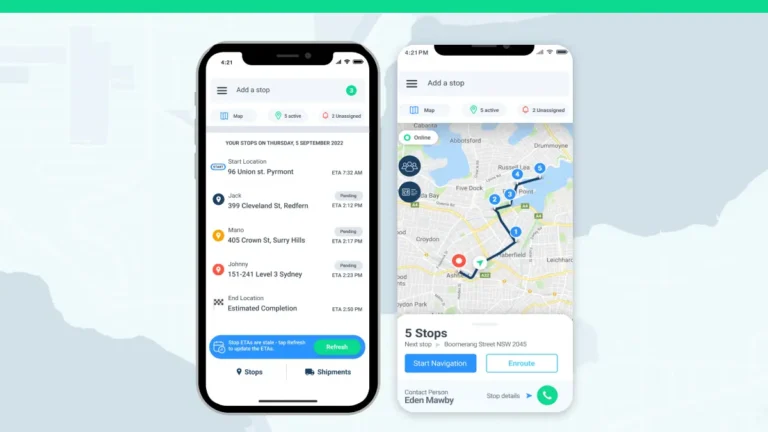

Smith says if a partner can’t deliver accurate time tracking, they need to be looked at with extra scrutiny. “I’d be looking at the tech of the freight partners that you have and making sure that you’re set up for a turnaround in the freight market sometime in the future.”

Flexport is adamant that come next year, with $1 billion in net cash, it’s in a “great position” to return to profitability.

The United Parcel Service (UPS) says rates will likely remain low for the first nine months 2024. However, there could be growth and a return to peak shipping season in the last quarter. “However, ongoing global disruptions, such as the Israel-Hamas and Ukraine conflicts, could create volatility to oil prices, and, in turn, market rates, as the year progresses,” warns the postal service.

About the author

Mia is a multi-award-winning journalist. She has more than 14 years of experience in mainstream media. She's covered many historic moments that happened in Africa and internationally. She has a strong focus on human interest stories, to bring her readers and viewers closer to the topics at hand.